Studying the history of the EPRs goes back so far that it is hard to believe that it is about the same sector, still under construction. by Paul Marion, "la Tribune de l'Économie" 26/03/2023

Everything began at the Franco-German summit in 1989. At that time, the agreement between President Mitterrand and German Chancellor Helmut Kohl was moving forward hand in hand and both of the then partners wanted to symbolise their cooperation in ambitious projects. What could be more strategic than the energy sector? The European Pressurised Reactor programme was officially launched in 1992. In a Europe still frightened by 1984 Chernobyl disaster, the EPR promises to deliver more power with optimum safety.

But behind the good understanding of the leaders, the relationship between the French and German engineers was far from idyllic because the opinions were too different. At the end of the 1970s and 1980s, the French nuclear industry was ultra-competitive and was being exported all over the world. Moreover, EDF was not happy to have to design a new reactor and to throw away its work on the REP-2000 reactor, the announced successor to the N4+ reactor, the last model to have been commissioned to date in France at Civaux in the late 1990s.

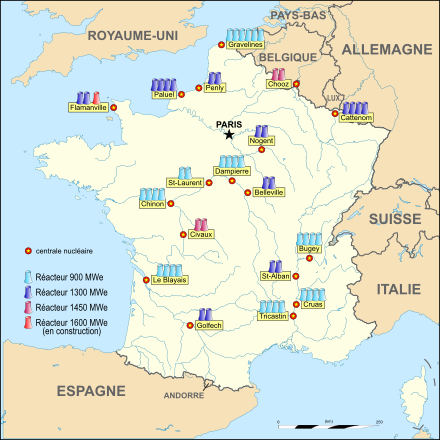

Map of French nuclear civil sitesThe French and German safety authorities also have different ideas, with Germany calling for much thicker concrete and steel protective enclosures around the reactor. Without reaching agreement, each added its own regulations to the specifications, which were designed as a cathedral of standards. Until it becomes impossible to build? "The EPR is too complicated, almost unbuildable," admitted former EDF CEO Henri Proglio during a hearing at the National Assembly.

Monster of steel and concrete

"The EPR technology is not so different from that of existing reactors. All its difficulty comes from the safety architecture, involving much more concrete, steel, and warning systems than the previous reactors," summarises Nicolas Goldberg, an energy expert at Colombus Consulting, to describe this "monster" of steel and concrete that former EDF executive director Hervé Machenaud talks about.

Unfortunately, Germany is a capricious partner, which after dictating its conditions, withdraws from the project because the government changes. Indeed, in 1998 in Germany, the ecologists who entered the government stopped the German nuclear projects. The French industrialists alone inherited a reactor design that they had not really wanted and that did not guarantee them any orders.

At the end of the 1990s, the climate became unfavourable to nuclear power in France. Under pressure from his ecologist allies, represented in the government in 1997 by Environment Minister Dominique Voynet, Prime Minister Lionel Jospin delayed launching the first EPR projects. Impatience grew in the industry.

Two failures

Faced with the absence of work in France, French companies looked abroad for new markets and found them. In Finland, Areva, ex-Framatome (manufacturer of nuclear boilers and historical partner of EDF), won the manufacturing of two EPR reactors in Olkiluoto in the south-west of the country, together with Siemens. Too happy to have the world's first reactors built, the two companies conceded considerable discounts.

Without making her fortune, Areva's boss, Anne Lauvergeon, wants to make Olkiluoto a showcase for her company's skills in order to win other contracts elsewhere. In its obsession to outstrip its rivals, whether EDF, the Americans from Westinghouse or the Koreans from Kepco, Areva has rushed and underestimated the scale of the task when only 10% of the design study has been completed.

What should be a pioneering work is now a financial abyss that is gradually swallowing up its resources and the company itself. The budget swelled from 3.4 to 11 billion euros, as did the deadlines, which were finally twelve years late.

Deindustrialisation and loss of know-how

For EDF, the "project of the century" began in 2007, three years after the Raffarin government's approval. At Flamanville in the English Channel, proof of the proper functioning of the EPRs must be demonstrated, at a time when Areva is bogged down in Olkiluoto. From the Baltic to the English Channel, the same unpreparedness leads to the same failure. The costs are increasing in the same way, from 3.5 to 13.2 billion euros, with twelve years of delay at the very least.

In less than two decades, the reputation of the French nuclear sector has been damaged. How to explain two almost twin industrial failures? According to the conclusions of the Court of Auditors, the fierce competition between Areva and EDF has been undermining the French industry from inside, whose skills are almost lost after eleven years without any reactor production.

"De-industrialisation, synonymous with the loss of know-how in the production of concrete and the quality of welds, has weighed heavily on Flamanville in particular. The absence of mass production sites has prevented the maintenance of a network of subcontractors due to a lack of visibility. The same difficulties can be seen in all Western countries in building reactors, EPR or not. These difficulties are not inherent to the nuclear industry," insists Nicolas Goldberg, who notes that, on the other hand, "the construction of EPRs is not experiencing these difficulties in China," which is building reactors in series throughout its territory.

In 2007, the Chinese entrusted Framatome and EDF with the construction of two EPRs in Taishan.

The Taishan and Hinkley Point plants to make people forget the Flamanville plant

Enlightened by its previous failures and supported by the recent experience of the Chinese, EDF manages this time to activate two first generation EPR reactors in Taishan within ten years. In another export victory, EDF was commissioned in 2013 to supply two EPR reactors to the Hinkley Point plant in the UK in collaboration with the Chinese CGN. Slower than Taishan but less difficult than Flamanville, Hinkley Point C is due to be completed in 2026. It is the last of the first generation EPRs to be built.

Since 2011, a second, simplified version of the EPR 2 has been in the pipeline, based on feedback from the construction sites.

"The EPR 2 should not even be called an EPR because it is so different. Compared to the EPR 1, we are removing a containment vessel, overlays, safety circuits and buildings to make a reactor that is half the price and, above all, much easier to build than the one in Flamanville," says Tristan Kamin, a nuclear engineer who points out, for example, that "we are going from 1,700 door references to less than 70.

An immense but not insurmountable challenge

Faced with the endless difficulties of the construction sites, could the pure and simple abandonment of the EPR project have been thought of for a while? "In 2011, EDF did not see itself starting from scratch. There is a ratchet effect. The further we go, the more money we invest, the less we can turn back," says Nicolas Goldberg. The completion of Taishan and Olkiluoto, the convincing progress of Hinkley Point in the United Kingdom, two EPR 2s co-built in the United Kingdom by EDF, give grounds for hope.

The future of France's energy depends on this EPR 2 model. Its design is currently being developed to reach 70% completion when the first construction sites begin. In February 2022, in the famous nuclear boiler factory in Belfort, Emmanuel Macron announced the construction of six new EPRs, marking the end of a twenty-year period of hesitation by the State for political reasons. The Head of State set a huge but not insurmountable goal. "The industry is ready to build this major project," proclaimed the Groupement des Industriels Français de l'Energie Nucléaire (Gifen), which praised the lessons of the past and the future prospects offered by the revival of the atom.

"That's it, we're out of the woods on EPRs. In China and Finland, the reactors are running. Elsewhere, the problems have been identified, even if the enormous cost of the EPR projects, which were initially presented as more economical, remains," Tristan Kamin agrees with Nicolas Goldberg. The fact remains that today, no electron has yet come out of an EPR nuclear power plant in France. Flamanville is due to go into service in mid-2024 at the earliest. That is 32 years after the start of the EPR programme.